Of the 49 cents remaining, almost 35 cents is used by operating expenses (selling, general and administrative), 1 cent by other and 2 cents in interest. We earn almost 11 cents of net income before taxes and over 7 cents in net income after taxes on every sales dollar. This is a little easier to understand than the larger numbers showing Synotech earned $762 million dollars. Conducting a common size balance sheet analysis can let you quickly see how your assets and liabilities stack up. Ideally, you want a low liability-to-asset ratio, as this indicates you will be able to easily pay your business’s obligations. This low ratio is favorable especially if you’re applying for a business loan, since lenders want to be assured that you’re financially solvent enough to take on and repay additional debt.

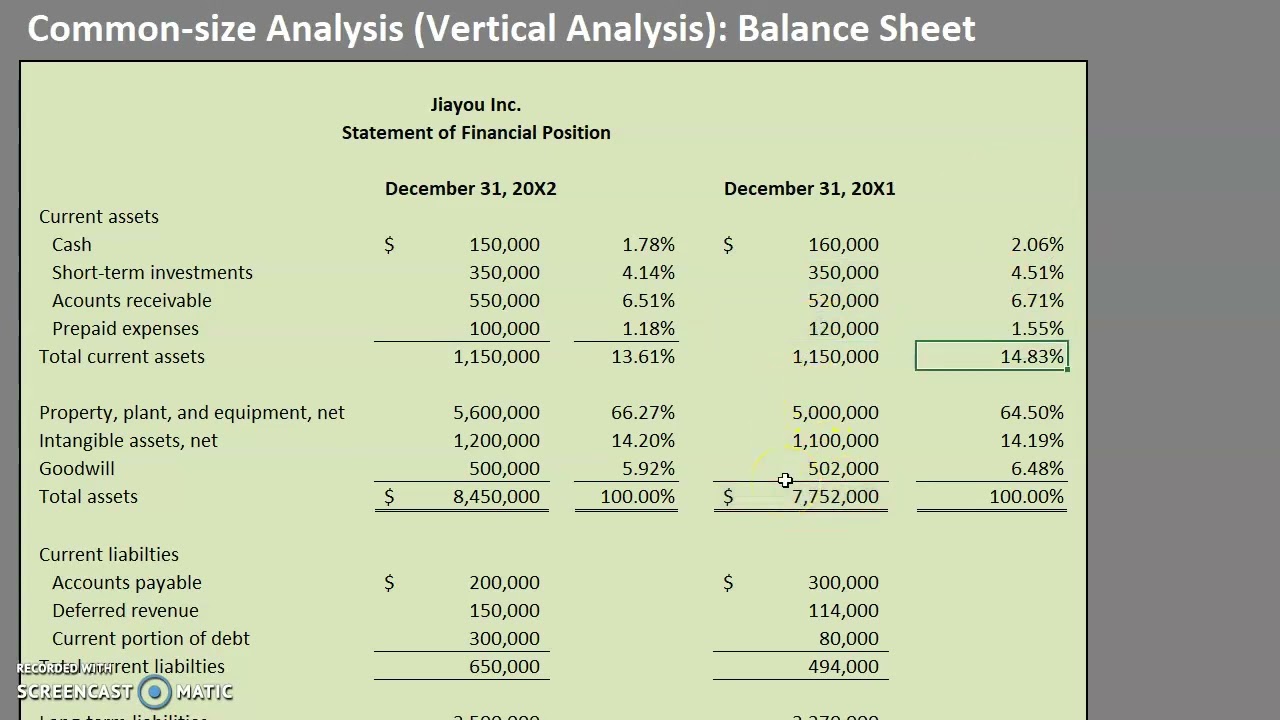

Common size balance sheet analysis

Ultimately, positive cash flow from financing activities left the business with a positive cash position of $13,000. In the future, the company can improve by decreasing investment expenditures and increasing revenue from operating activities. It’s important to add short-term and long-term debt together and compare this amount to the total cash on hand in the current assets section.

You’re our first priority.Every time.

The common-size method is appealing for research-intensive companies because they tend to focus on research and development (R&D) and what it represents as a percent of total sales. For instance, it can be seen that there is a relative decrease in the long-term investments from 2016 to 2018, while the current liabilities have witnessed an uptrend during the same period. An analyst can further deep dive to determine the reason behind the same to make a more meaningful insight. Common-size Statements are accounting statements expressed in percentage of some base rather than rupees. Before breaking down the different types of common size analysis, it’s worth understanding that it can be conducted in two ways.

Common size cash flow statement analysis

On the other hand, common size financial statements give percent rather than absolute values and are easier to compare among firms or over time. A common size financial statement is a specific type of statement that outlines and presents items as a percentage of a common base figure. The process of creating a common size financial statement is often referred to as a vertical analysis or a common-size analysis. This balance sheet also reports Apple’s liabilities and equity, each with its own section in the lower half of the report.

Limitations of Common Size Financial Statements

It facilitates making it easier to compare companies or different periods because raw numbers transformed into percentages are easier to notice for trends and strategic decisions to be taken. It is very crucial in income statements, balance sheets, and cash flow statements. The only difference is that each line item on this accounting balance sheet is expressed as a percentage of total assets. Financial statements that show only percentages and no absolute dollar amounts are common-size statements. All percentage figures in a common-size balance sheet are percentages of total assets while all the items in a common-size income statement are percentages of net sales.

For example, it could be cash flows from financing, cash flows from operations, and cash flows from investing. Also known as the profit and loss statement, the income statement is an overview. To find net income common size balance sheet example using the income statement equation, you simply minus sales from expenses. Even though common size analysis doesn’t provide as much detail, it can still be effective in analyzing financial statements.

Without context, a comparative point, knowledge of its previous cash balance, and an understanding of industry operating demands, knowing how much cash on hand a company has yields limited value. On the debt and equity side of the balance sheet, however, there were a few percentage changes worth noting. In the prior year, the balance sheet reflected 55 percent debt and 45 percent equity.

Each financial statement uses a slightly different convention in standardizing figures. The current assets formula determines that the «total current assets,» which are the total of all assets that can be converted to cash within one year, makes up 37% of the company’s total assets. In contrast, current liabilities, which are debts due within one year, make up only 30% of the company’s total assets. For example, if Company A has $1,000 in cash and $5,000 in total assets, this would be presented in a separate column as 20% in a common size balance sheet. Common size financial statements compare the performance of a company over periods of time.

- Creating common-size financial statements makes it easier to analyze a company over time and compare it to its peers.

- It can also highlight the expense items that provide a company a competitive advantage over another.

- The term «common size» is most often used when analyzing elements of the income statement, but the balance sheet and the cash flow statement can also be expressed as a common size statement.

- The company should look for ways to cut costs and increase sales in order to boost profitability.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

This balance sheet compares the financial position of the company as of September 2020 to the financial position of the company from the year prior. So there are benefits to preparing common-sized financial statements, but you have to look for their limitations and consider the changes before comparing and taking results. You can compare and get results of different financial periods of the same company or other companies in the same industry. Share repurchase activity as a percentage of total sales in each of the three years was minimal or non-existent.

Common-size financial statements facilitate the analysis of financial performance by converting each element of the statements to a percentage. This makes it easier to compare figures from one period to the next, compare departments within an organization, and compare the firm to other companies of any size as well as industry averages. On the income statement, analysts can see how much of sales revenue is spent on each type of expense. They can see this breakdown for each firm and compare how different firms function in terms of expenses, proportionally. They can also look at the percentage for each expense over time to see if they are spending more or less on certain areas of the business, such as research and development.